Business Insurance in and around Taylorville

Calling all small business owners of Taylorville!

This small business insurance is not risky

Insure The Business You've Built.

Do you own a window treatment store, a HVAC company or a veterinarian? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on your next steps.

Calling all small business owners of Taylorville!

This small business insurance is not risky

Strictly Business With State Farm

When one is as enthusiastic about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for artisan and service contractors, worker’s compensation, commercial liability umbrella policies, and more.

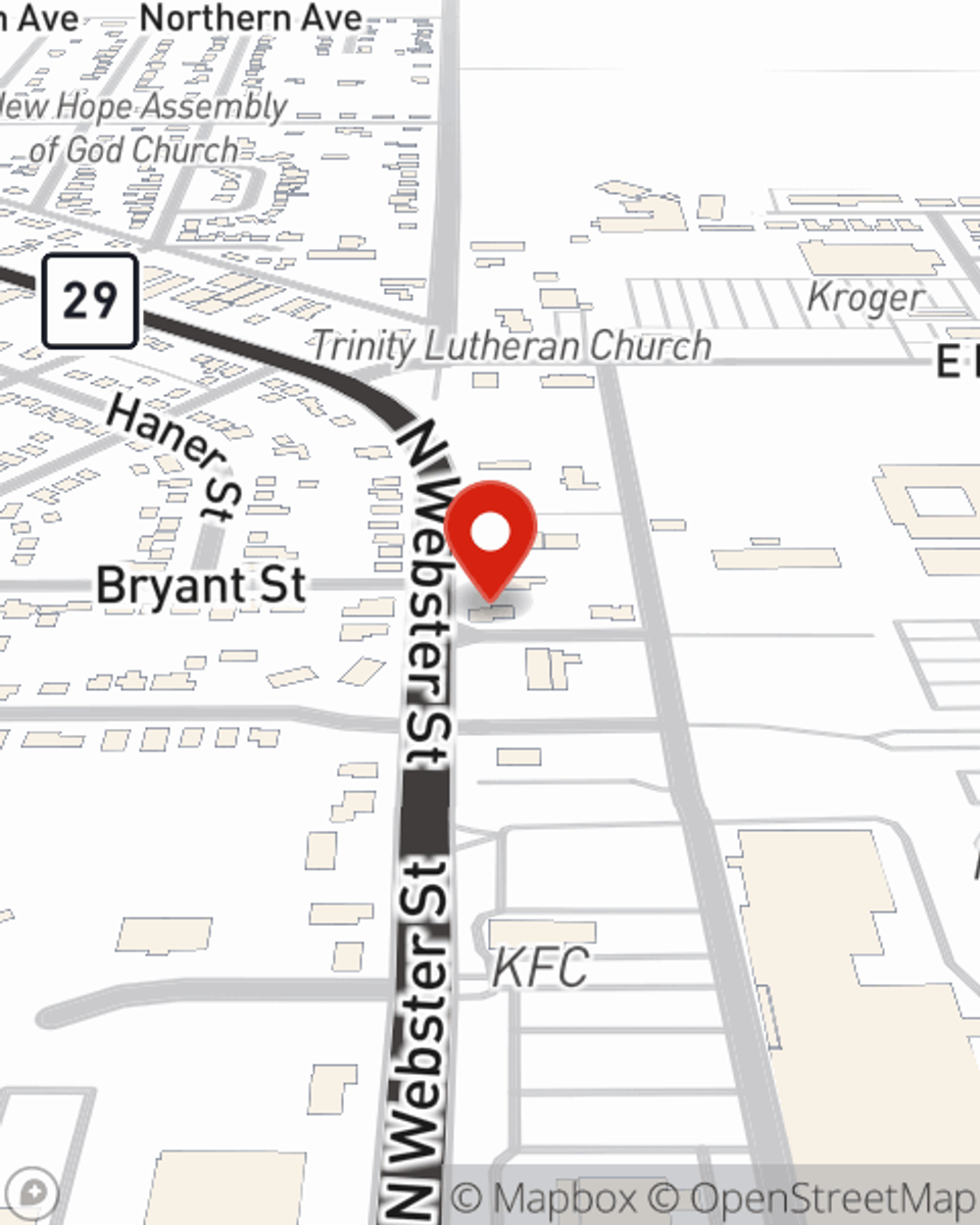

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Eric Kahle's office today to discuss your options and get started!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Eric Kahle

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".